| 1. | Date & Time16th July 2022 at 10.00 am |

| 2. | VenueThe Company is conducting meeting through VC/OAVM pursuant to the MCA Circular dated May 5th, 2020… |

| 3. | Date of Book Closure15.07.2022 – 16.07.2022 (Both Days inclusive) |

| 4. | Financial Year of CompanyApril to March |

| 5. | Corporate & Registered OfficeNo. 80/2 Lusanne Court, Richmond Road, Bangalore-560025 |

| 6. | Exchanges Listed atBSE Limited, P J Towers, No. 25 Dalal Street, Mumbai – 400001 |

| The Listing Fees for the financial year 2021-22 has been paid. | |

| 7. | Stock CodeBSE – 526433 |

| 8. | D’mat ISIN No.INE867C01010 |

| 9. | Payment of DividendThe Board has recommended final dividend of Rs. 2.50 per equity share… |

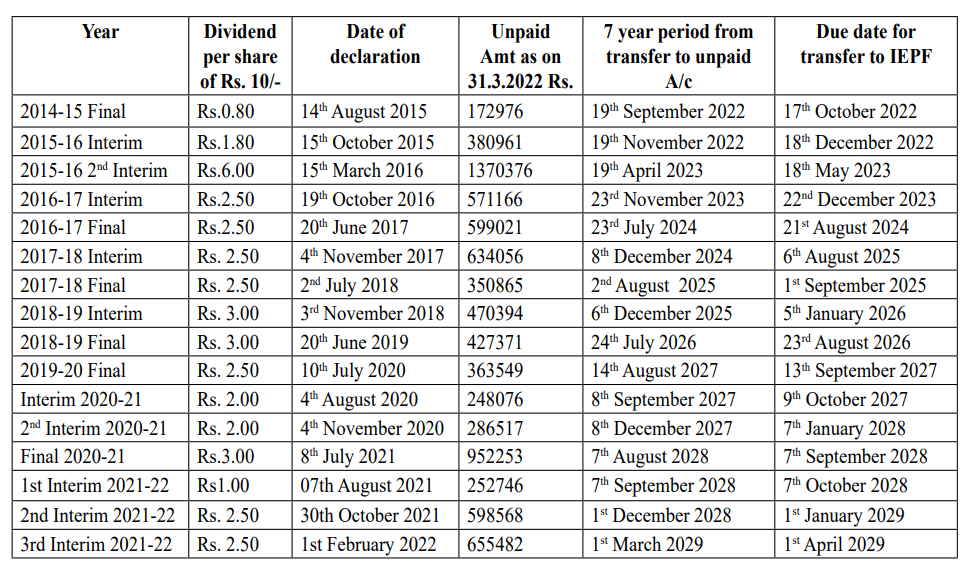

| 10. | Unclaimed DividendSection 124 of the Companies Act, 2013 mandates… |

|

|

| 11. | Shares Transferred to IEPFPursuant to Section 124(6)… |

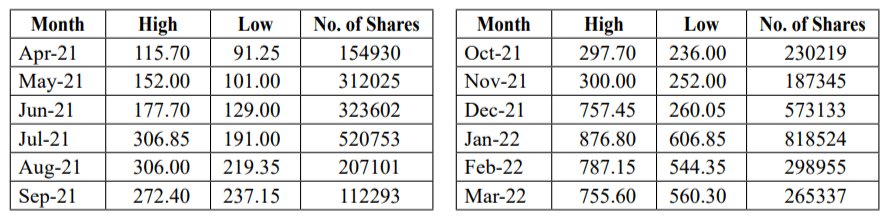

| 12. | Market Price DataThe month wise high and low prices… |

|

|

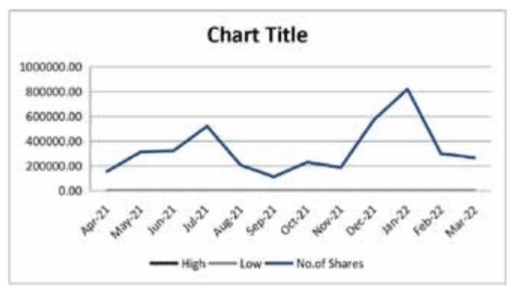

ASML Volume of shares traded at BSE

|

|

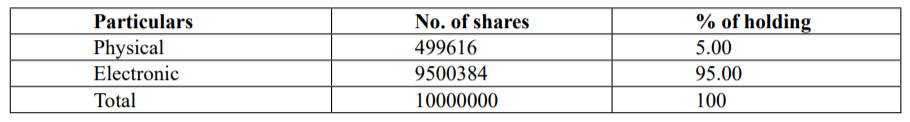

| 13. | Dematerialisation of Shares95% of the capital has been dematerialised… |

| 14. | Market CapitalisationRs. 5700.00 Mn (as on 31.3.2022) |

| 15. | No. of EmployeesMale – 1039, Female – 152 |

| 16. | No. of Shareholders15905 |

| 17. | Share TransfersTransfers are processed by NSDL/CDSL… |

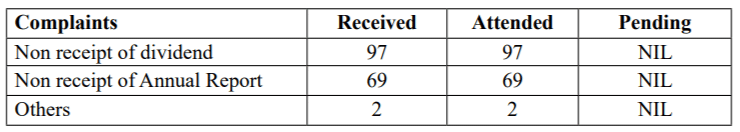

| 18. | Complaints Received/Solved |

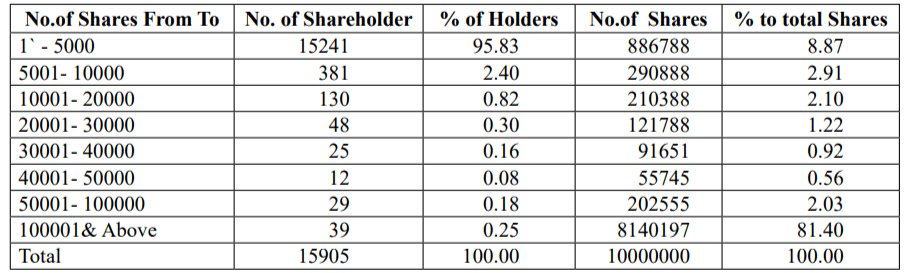

| 19. | Distribution of Shareholding |

| 20. | The company does not have any outstanding GDRs/ADRs/warrants… |

| 21. | Office LocationsThe addresses are given in the Annual Report. |

| 22. | Material Subsidiary PolicyAvailable at: ASM-Policy |

| 23. | Commodity Price RiskNo commodity hedging is done. |

| 24. | Corporate Governance ComplianceThe Company has complied with all requirements. |

| 25. | Physical & Electronic Shareholding |

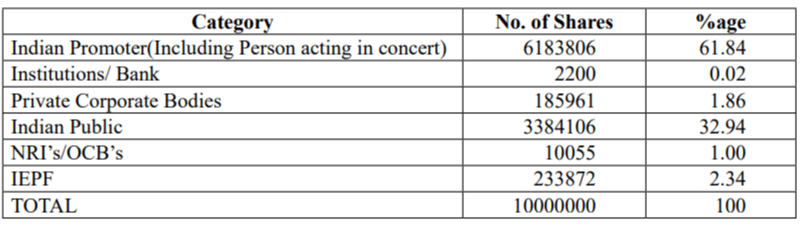

| 26. | Shareholding Pattern |

| 27. | Investor Correspondence

Registrars & Share Transfer Agents

KFin Technologies Pvt. Ltd.

Karvy Selenium Tower B, Plot No. 31 & 32,

Financial District, Nanakramguda, Serilingampally Mandal,

Hyderabad – 500 032, Telangana.

Email id: [email protected]

Website: https://www.kfintech.com

Toll free number: 040-67162222

Compliance OfficerMs. Vanishree Kulkarni Company Secretary # 80/2, Lusanne Court, Richmond Road Bangalore – 560 025 Tel: 080-66962300 Email: [email protected] |